“The love of money,” the Bible tells us, “is the root of all kinds of evil” (1 Timothy 6:10). After the financial crash of 2008 and the subsequent global economic crisis that continues to plague society today, it is hard not to empathise with these words from The Good Book.

Similar language is repeated in The Ragged Trousered Philanthropists, the early 20th century novel by Robert Tressell, which is often considered a modern-day bible for the labour movement. In this fictionalised account of the lives of the working class, the protagonist, a socialist called Frank Owen, asserts to his incredulous peers that, “Money is the principal cause of poverty.” (Robert Tressell, The Ragged Trousered Philanthropists, Wordsworth Classics edition, p175)

Owen valiantly attempts to explain further to his fellow workers how, “while the present Money System remains, it will be impossible to do away with poverty, for heaps in some places mean little or nothing in other places. Therefore while the money system lasts we are bound to have poverty and all the evils it brings in its train.” (Ibid, p284)

“The present Money System prevents us from doing the necessary work, and consequently causes the majority of the population to go short of the things that can be made of work. They suffer want in the midst of the means of producing abundance. They remain idle because they are bound and fettered with a chain of gold.” (Ibid, p286)

“This systematic robbery has been going on for generations, the value of the accumulated loot is enormous, and all of it, all the wealth at present in the possession of the rich, is rightly the property of the working class – it has been stolen from them by the means of the Money Trick.” (Ibid, p299)

Money, then, as Tressell states through the medium of his hero Owen, appears to us a mystical force; a “chain of gold” that tethers the vast majority of the population to a life of toil and misery; a great “trick” that swindles the working class of the wealth that they have created. We see it all around us, ubiquitous and abundant; and yet, amidst this plenty we find universal want. Within this “Money System”, all our needs become relegated to the need for money – in the words of the Bard, “Thou common whore of mankind.” (William Shakespeare, Timon of Athens, Act IV, Scene 3)

Whether it is the monetary policies of central banks, such as the euphemistically named Quantitative Easing; the financial alchemy taking place inside the glass towers of Canary Wharf and the City of London; or the utopian alternatives offered by digital currencies such as Bitcoin: for most people, the workings of the modern Money System are shrouded in mystery.

As with all such revered idols in class society, however, whether it be the gods and religion or the Law and the State, by applying the method of Marxism – that is to say, a dialectical and materialist analysis of history and society – we can understand and explain the origins, evolution, and development of money. In doing so, we can strip away the mysticism of this seemingly omnipotent power and understand the solution to removing its grip over us.

Primitive communism

Studying history, we see that money did not always exist, but is tied to the development of class society and, in particular, of commodities – that is, of goods produced not for individual or common consumption, but for exchange. For Marx, the key to understanding the question of money therefore lay in analysing the historical development of commodity production and exchange. “The riddle of the money fetish,” Marx states in his magnum opus, Capital, “is therefore the riddle of the commodity fetish, now become visible and dazzling to our eyes.” (Karl Marx, Capital, Volume One, Penguin Classics edition, p187)

Basing himself on the works of the pioneering 19th century American anthropologist Lewis H. Morgan, Friedrich Engels – Marx’s co-founder of the ideas of scientific socialism – analysed the earliest forms of human society, demonstrating in his classic text the Origin of the Family, Private Property, and the State how social classes of exploiters and the exploited had not always existed. Instead, Engels explained, early societies were generally based on “gens”, or tribes, within which there was communal ownership over the tools and products.

Such communities, therefore, were a form of “primitive communism”, where there was no exchange between individuals, but rather production for the common good, and consumption on the basis of need. At the same time, this “communism” was “primitive” since it was on the basis of a general scarcity, resulting from a low level of productivity, technology, and culture.

For example, in his recent book on Debt: the First 5,000 Years, David Graeber, the modern US anthropologist, cites the example given by his predecessor Morgan of the Iroquois gens, a group of Native American tribes whose societal structure Engels also drew upon in his works. “By the mid-[19th] century,” Graeber notes, “Lewis Henry Morgan’s descriptions…made clear that the main economic institution among the Iroquois nations were longhouses where most goods were stockpiled and then allocated by women’s councils, and no one ever traded arrowheads for slabs of meat.” (David Graeber, Debt: the First 5,000 Years, Melville House publishing, 2014 paperback edition, p29)

Elsewhere, as the author Felix Martin notes in his book Money: the Unauthorised Biography, in the earliest known civilisations that developed around the Mesopotamian rivers of the Tigris and the Euphrates – in what is modern-day Iraq – money did not exist either. It was here in ancient Mesopotamia that the techniques of irrigation and agriculture were invented and – in turn – the formation of the first cities began, such as the “great metropolis” of Ur. “By the beginning of the second millennium BC,” Martin states, “more than sixty thousand people lived within the city itself…thousands of hectares of land were under cultivation…and hundreds more were devoted to dairy farming and sheep herding.” (Felix Martin, Money: the Unauthorised Biography, Vintage publishing, 2014 paperback edition, p38)

In such urban economies, Martin explains, in place of money we instead find a system of top-down planning and accounting, managed by a bureaucratic caste, in which all produce would be kept in the city’s stores (often royal palaces and temples), with inscribed tablets used to keep records; “a complex economy governed according to an elaborate system of economic planning that would be familiar to a manager in a modern multinational corporation.” (Ibid, p44)

Whether it be the primitive communism of the Iroquois gens or the bureaucratic planning seen in Mesopotamian cities, therefore, such examples clearly demonstrate how money – and all its associated “evils” – is not a timeless eternal truth. To understand what money is and where it has come from, we must analyse the qualitative transformation in the social relations that took place within society thousands of years ago.

The rise of money

Early Greek societies – as described in the epic poems of Homer, such as the Iliad and the Odyssey – were, like the Iroquois, based around gens, with common ownership over the productive forces and resultant products. Felix Martin describes how, “For the provision of the most basic needs – food, water, and clothing…it was essentially an economy of self-sufficient households in which the individual tribesmen subsisted on the produce of his own estate.” (Ibid, p35)

In addition to this economy of individual subsistence, Martin continues, were “three simple mechanisms for organising society in the absence of money – the interlocking institutions of booty distribution, reciprocal gift-exchange, and the distribution of the sacrifice,” which were “far from unique to Dark Age Greece. Rather, modern research in anthropology and comparative history has shown them to be typical of the practices of small-scale, tribal societies.” (Ibid, p36-37)

The historical turning point, Engels explains in the Origin of the Family, Private Property, and the State, occurred with the development of private ownership over the means of production, and the associated conversion of communal products into commodities.

“The rise of private property in herds and articles of luxury led to exchange between individuals, to the transformation of products into commodities. And here lie the seeds of the whole subsequent upheaval. When the producers no longer directly consumed their product themselves, but let it pass out of their hands in the act of exchange, they lost control of it. They no longer knew what became of it; the possibility was there that one day it would be used against the producer to exploit and oppress him. For this reason no society can permanently retain the mastery of its own production and the control over the social effects of its process of production unless it abolishes exchange between individuals.

“But the Athenians were soon to learn how rapidly the product asserts its mastery over the producer when once exchange between individuals has begun and products have been transformed into commodities.” (Friedrich Engels, The Origin of the Family, Private Property, and the State, chapter V)

The process that Engels describes initially develops, not internally within the community, but at the fringes of a given society with the trade of surplus products between different tribes. Such trade, however, sets the wheels of commodity production exchange in motion, later rebounding to spread internally, reinforce private ownership, and accelerate the dissolution of communal bonds.

With the development of commodity production and exchange came the expansion of trade; and with growing trade came the emergence of the money commodity – a universal equivalent that could act as a means of exchange, facilitating trade over longer distances; a single commodity that acts as a yardstick of measurement, against which all others could be compared.

Such a process does not come about consciously or in a planned manner, but arises out of the needs of society to expand trade and the market. The initial commodity that is elevated to the status of this universal equivalent is largely accidental, in a historical sense; nevertheless, it is rooted in the material needs of that society, and is generally – in the earliest stages – that which is considered the most important commodity to the particular society in question. As Marx notes in Capital,

“What appears to happen is not that a particular commodity becomes money because all other commodities express their values in it, but, on the contrary, that all other commodities universally express their values in a particular commodity because it is money.” (Marx, op. cit., p187)

For example, in the case of the Native American tribes, Engels explains, it was cattle that emerged as the money commodity:

“Originally tribes exchanged with tribe through the respective chiefs of the gens; but as the herds began to pass into private ownership, exchange between individuals became more common, and, finally, the only form. Now the chief article which the pastoral tribes exchanged with their neighbours was cattle; cattle became the commodity by which all other commodities were valued and which was everywhere willingly taken in exchange for them – in short, cattle acquired a money function and already at this stage did the work of money. With such necessity and speed, even at the very beginning of commodity exchange, did the need for a money commodity develop.” (Engels, op. cit., chapter IX)

The expansion and growth of trade in ancient Greece, however, led to the need for a money commodity that was portable over longer distances. For this reason, we see, beginning in Greece in the late-6th century BC, the emergence of coinage, with the use of precious metals – such as gold and silver – as money.

The beneficial material properties of such metals for use as money are clear: they are generally homogeneous and uniform in their quality – one lump of gold is much the same as any other; they are easily divisible (or combinable) into different amounts, and can thus be used to easily represent different quantities of value; they are durable and therefore do not deteriorate and lose value, thus enabling them to be a store of value; and, most importantly, they have a high density of value, with small amounts of precious metal being equivalent to a large quantity of other, less valuable, commodities. Gold, therefore, is money not because of its revered aesthetic qualities, but is considered to be aesthetical pleasing because it is money.

The rise of money and coinage was, as Engels explains, associated also with the increasing division of labour within class society, and the emergence of “a class which no longer concerns itself with production, but only with the exchange of the products–the merchants.”

“Now for the first time a class appears which, without in any way participating in production, captures the direction of production as a whole and economically subjugates the producers; which makes itself into an indispensable middleman between any two producers and exploits them both. Under the pretext that they save the producers the trouble and risk of exchange, extend the sale of their products to distant markets and are therefore the most useful class of the population, a class of parasites comes into being, ‘genuine social ichneumons’, who, as a reward for their actually very insignificant services, skim all the cream off production at home and abroad, rapidly amass enormous wealth and correspondingly social influence, and for that reason receive under civilization ever higher honours and ever greater control of production, until at last they also bring forth a product of their own – the periodical trade crises.”

“…And with the formation of the merchant class came also the development of metallic money, the minted coin, a new instrument for the domination of the non-producer over the producer and his production. The commodity of commodities had been discovered, that which holds all other commodities hidden in itself, the magic power which can change at will into everything desirable and desired. The man who had it ruled the world of production–and who had more of it than anybody else? The merchant. The worship of money was safe in his hands. He took good care to make it clear that, in face of money, all commodities, and hence all producers of commodities, must prostrate themselves in adoration in the dust. He proved practically that all other forms of wealth fade into mere semblance beside this incarnation of wealth as such.” (Ibid)

Money then, as Engels explains, is the product of private ownership; the result of an emergent system of commodity production and exchange. Once called into existence, however, money develops its own logic, spreading through social interaction and asserting its cold, callous laws in one sphere of life after another. Money and usury, Engels stated, were “the principal means for suppressing the common liberty,” breaking apart the old communal bonds of the Greek gens, and reinforcing the inequalities and exploitation of the newly emerging class society of the Athenian state.

“From here the growing money economy penetrated like corrosive acid into the old traditional life of the rural communities founded on natural economy. The gentile constitution is absolutely irreconcilable with money economy…[it] knew neither money nor advances of money nor debts in money. Hence the money rule of the aristocracy now in full flood of expansion also created a new customary law to secure the creditor against the debtor and to sanction the exploitation of the small peasant by the possessor of money…

“With the coming of commodity production, individuals began to cultivate the soil on their own account, which soon led to individual ownership of land. Money followed, the general commodity with which all others were exchangeable. But when men invented money, they did not think that they were again creating a new social power, the one general power before which the whole of society must bow. And it was this new power, suddenly sprung to life without knowledge or will of its creators, which now, in all the brutality of its youth, gave the Athenians the first taste of its might.

“What was to be done? The old gentile constitution had not only shown itself powerless before the triumphal march of money; it was absolutely incapable of finding any place within its framework for such things as money, creditors, debtors, and forcible collection of debts. But the new social power was there; pious wishes, and yearning for the return of the good old days would not drive money and usury out of the world.” (Ibid, chapter V)

Credit money

As Engels hints at above, with his reference to the “yearning for the return of the good old days” when “money and usury” did not exist, as long as there has been money there has been credit and debt; and as long as there has been usury, there has been the “forcible collection of debts” – “a new social power…before which the whole of society must bow.”

Some monetary theorists, however, try to emphasise that money is – above all – nothing but a system of credits and debts; a set of accounts and balances representing the distribution of society’s wealth amongst its population. What we see in terms of the exchange of coin and currency are, within this framework of understand money, merely a means of settling accounts and making transfers between different balances – money as a means of payment.

Such ideas, which are known generally as the credit (or debt) theory of money, were most thoroughly put forward by the early-20th century British economist, Alfred Mitchell Innes, and are supported, according to David Graeber in his book Debt: the First 5,000 Years, by modern anthropological evidence.

According to Innes and Graeber, our modern conception of money – as outlined in academic textbooks – is fundamentally based on a myth: the “myth of barter”, as Graeber describes it, which has spread into the popular imagination and consciousness as a result of the works of the classical political economists, such as Adam Smith and David Ricardo, and before them the theories of the English empiricist, John Locke, and even the ancient Greek philosopher, Aristotle.

For the classical economists, money was primarily considered a means of exchange – a single commodity that rises above all others to become universally accepted in order to facilitate trade. The use of a particular commodity as money, such as gold, lay in its own high value density. Before money, the story goes, there was no way of trading other than through barter. This clearly posed problems, since it would require both that individuals with mutually reciprocating needs crossed paths, and that traded goods be carried around, ready for exchange. Hence the invention of money, to overcome the barriers of barter, and extend both the variety of goods that could be exchanged and the distance over which they could be traded.

The problem, Graeber notes, quoting the Cambridge anthropologist Caroline Humphrey, is that: “No example of a barter economy, pure and simple, has ever been described, let alone the emergence from it of money; all available ethnography suggests that there never has been such a thing.” (Graeber, op. cit., p29)

It should be noted, however, that this anthropological narrative of the “myth of barter” is based on the search for a barter economy – that is, for a community in which the internal exchange of goods through barter took place. But as Engels (and Marx also) noted, the development of commodity exchange through barter does not initially occur internally within the community, but externally, at the edges where different tribes interact. It should come as no surprise, therefore, that “no example of a barter economy” can be found historically.

For those putting forward the credit / debt theory of money – in contrast to the classical economists and their commodity theory of money – the main role of money is not as a means of exchange, but as a unit of account. In this modern age of capitalism, with its highly developed credit system, fractional reserve banking, and electronic transfers, the idea that money is more than just the coins and cash in circulation may seem obvious. But at the time of Smith, Ricardo, et al., such an idea was not considered a self-evident truth. Even today, there are those who – looking around at the collapse of the financial system in the wake of the 2008 banking crisis, not to mention the ever-inflating credit bubbles and printing of money through quantitative easing that continues today – understandably call for a return to the gold standard in order to restore calm and order to the global monetary system.

As a means of account, then, money is primarily a system of credits and debts. As Graeber emphasises: “We did not begin with barter, discover money, and then eventually develop credit systems. It happened precisely the other way around. What we now call virtual money came first. Coins came much later, and their use spread only unevenly, never completely replacing credit systems.” (Ibid, p40)

Felix Martin highlights two examples in Money: the Unauthorised Biography to stress the point. The first is the case of the people of Yap, a remote and secluded island in the Pacific. An American anthropologist called William Furness, visiting Yap in 1903, was amazed to discover that the small island’s economy consisted of only a few traded commodities; and, more importantly, there was neither barter, nor any currency acting as a means of exchange. Instead, Yap had a highly developed monetary system involving large stone wheels called “fei”, up to twelve feet in size, which were used to represent and account for the various amounts of wealth held by individuals within the community.

Notably, Martin says, Furness “observed that physical transporting of fei from one house to another was in fact rare. Numerous transactions took place – but the debts incurred were typically just offset against each other, with any outstanding balance carried forward in expectation of some future exchange. Even when open balances were felt to require settlement, it was not usual for fei to be physically exchanged.” (Martin, op. cit., p4)

“Yap’s money was not the fei,” Martin continues, “but the underlying system of credit accounts and clearing of which they helped to keep track. The fei were just tokens by which these accounts were kept.” (Martin, op. cit., p12)

Closer to home, Martin provides another example of such credit money in the form of “Exchequer tallies” – wooden sticks used in England between the 12th and 18th centuries to record payments either to or from the state. Such sticks would be split down the middle, with the creditor and debtor keeping one half each as a receipt of the payment. Notably, the creditor’s half could be used as a means of payment – a form of financial security, exchanged with another individual to settle an unrelated debt.

It wasn’t until 1834 that these Exchequer tallies were finally abolished, replaced by the Bank of England with a system of paper notes. Those tallies that remained were burnt and destroyed, leaving little evidence of their existence behind. For similar reasons, Martin notes, the physical evidence for all sorts of monetary systems throughout history – and particularly credit systems involving written accounts – may have been lost to us forever, with only the hard currency of coinage surviving today. As a result, both Martin and Graeber hypothesise, we are left predominantly with a concept of money that emphasises tangible commodities, such as the precious metals.

The labour theory of value

So what is money? Is it primarily a universal commodity, or is it above all a system of credits and debts? In the final analysis, the answer is both: money’s dual role as a means of exchange and as a unit of account are two sides of the same coin, so to speak.

What unites this dual nature of money – what both connects the examples of the fei, the Exchequer tallies, and ancient coinage, and separates these cases from the primitive communism or Mesopotamian top-down planned economies described earlier – is, fundamentally, its role as a measure – or representation – of value. The more pertinent question that arises from this, therefore, is: what is value?

As discussed earlier, the origins of money lie in the development of commodity production and exchange; commodities being those products that are made for a market. Marx begins in Capital by grappling with this question, explaining that commodities have two aspects to them. On the one hand all commodities are use-values – things that have a utility in society; on the other hand, such commodities must have an exchange-value – a quantitative relationship to other commodities (generally just referred to as the value of a commodity).

At the same time, Marx noted, there is clearly a divorce between these dual properties of a commodity; the former does not condition the latter – that is, the usefulness of a product bears little relation to its exchange-value. For example, a pen may be useful, and a car may be useful too; but clearly the average car is worth many thousand (normal) pens. Diamonds, meanwhile, are considered highly valuable, and yet they have very little actual social use.

The riddle that the classical economists, such as Smith and Ricardo, sought to solve – and the point of departure for Marx in his analysis of the capitalist system – was: what determined the ratio of exchange between different commodities? Why would a certain amount of one particular commodity be traded for a certain amount of any other commodity? In other words, what is the source of value?

In order to address this question, Marx first asked: what is the only thing that all commodities have in common? What aspect of a commodity exists that is both universal and comparable? What quality unites all the plethora of commodities that are produced for the market, with their multitude of uses, properties, and physical characteristics? The answer that Marx arrived at was labour.

All commodities, in the final analysis, are products of labour; and it is labour, ultimately, that is the source of all value. The exchange-value (or simply value), then, Marx explained, is expressed by the relative quantity of labour contained within different commodities – both in terms of the “living” labour added by the producer and the “dead” labour congealed within the raw materials and tools used in the process of production.

Marx, however, was not the first to assert that labour was the source of value. Such an idea had been raised by the classical economists (and even by those in ancient times). Marx developed this “labour theory of value”, however, by looking at the question not from the standpoint of the individual labourer, but of labour in the abstract – of society’s labour in general:

“With the disappearance of the useful character of the products of labour, the useful character of the kinds of labour embodied in them also disappears; this in turn entails the disappearance of the different concrete forms of labour. They can no longer be distinguished, but are all together reduced to the same kind of labour, human labour in the abstract.” (Marx, op. cit., p128)

The question of value, according to Marx, is not about the labour expended by the individual producer. Under capitalism, where commodity production and exchange is dominant and universal, commodities are not simply exchanged between individuals, but are bought and sold on the market. The producers and consumers frequently never – and, in fact, rarely ever – meet. As such, the individual character of any commodity is lost; instead, it simply becomes one example of a multitude of similar use-values.

In turn, the individual character of the labour contained within each commodity is lost. Buyers in the market do not care about the labour expended to produce any individual commodity, but only about the quantity of labour that is needed to produce such-and-such a commodity in general, on average. Sellers in the market – a truly global market today – must, therefore, compete against the average level of skill, technology, and organisation, found in their industry. It is this fact that forces companies to compete by investing in new machinery and methods in order to increase productivity and thus sell their products below the general average of their competitors.

The value of commodities, therefore, is not determined by examining the labour expended within an individual commodity, but only by looking at the labour required to produce a given, relatively homogenous, commodity in general. In this sense, Marx explained that the value of a commodity was not simply due to labour, as the classical economists had concluded, but due to socially necessary labour-time: “the labour-time required to produce any use-value under the conditions of production normal for a given society and with the average degree of skill and intensity of labour prevalent in that society.” (Marx, op. cit., p129)

In a relatively undeveloped market economy, there may be a degree of flexibility over the amount of one commodity exchanged for another in any individual, isolated act of exchange. The different quantities of labour-time congealed within the particular commodities are seemingly random, and in this sense, as indicated above, the value of a commodity appears accidental. As commodity exchange becomes generalised, however, each act of exchange loses its individual character, and the various “accidental” values – i.e. labour-times – seen in these concrete acts average out and a general, objective value – i.e. socially necessary labour-time – arises. The act of exchange, meanwhile, is the only proof of the social necessity of any given labour.

The general form of value arrives, therefore, historically at the point when the process of commodity production and exchange has become so universal that the relative values – that is, congealed labour-times – of commodities now present themselves, not as accidents, but as objective facts to buyers and sellers on the market.

We see, therefore, how the law of value – like any law in nature, history, and society – is not something timeless that is imposed from without, but something dialectical that emerges from the interactions within. Necessity expresses itself through accident. In the case of the law of value, this law only arises and asserts itself at the historical point where commodity production and exchange is generalised.

Money, in turn, is the ultimate expression of this generalisation of the law of value; the logical conclusion of the development of commodity production and exchange, which requires a universal yard stick – a standard measure – against which the value of all other commodities can be expressed.

Where commodity production and exchange have not taken hold in society, therefore, the concept of value is meaningless and, in turn, there is no social need for money. For example, as Felix Martin notes, “the immense sophistication of Mesopotamia’s bureaucratic, command economy had no need of any universal concept of economic value…It therefore did no develop the first component of money: a unit of abstract, universally applicable economic value.” (Martin, op. cit., p59)

“The simple commodity form is therefore the germ of the money-form.” (Marx, op. cit., p163)

Social relations and alienation

The important point that Marx’s emphasised, is that value – and therefore money also, in the form of prices – is ultimately a social relation: a relation between the labour of different individuals that, under a system of generalised commodity production and exchange, expresses itself as a relationship between things. “It is nothing but the definite social relation between men themselves which assumes here, for them, the fantastic form of a relation between things.” (Marx, op. cit., p165)

Money, therefore, is not a thing, but a set of relations. The monetary system, in turn, is neither merely the cash and coins in circulation, nor the numbers in an accountant’s books, but a system of social relations; an expression of the distribution of the wealth – produced by labour – within society. An individual’s monetary wealth, meanwhile, is simply a claim to an aliquot portion of this social wealth.

These social and economic relations are ultimately backed up by legal – that is, property – relations, which in the final analysis means the backing of the force of the state: “special bodies of armed men” (to use Lenin’s expression), which – within class society – act to defend the sanctity of private property relations. Although, as Graeber notes, “This does not mean that the state necessarily creates money…The state merely enforces the agreement and dictates the legal terms.” (Graeber, op. cit. p54)

As the use of money spreads, then, social relationships are increasingly transformed into monetary and financial relationships. In the words of Engels, quoted earlier, money acts as the “corrosive acid”, breaking apart all existing societal bonds. Commenting on the emergence of money in ancient Greece, Felix Martin echoes Engels, explaining how,

“…with the invention of coinage, a dream technology for recording and transferring monetary obligations from one person to another was born…The result was a further acceleration in the pace of monetisation. Everywhere, traditional social obligations were transformed into financial relationships…It is difficult to overstate the social and cultural impact of this first, revolution experience of monetisation…money would be the universal solvent that could dissolve all traditional obligations.” (Martin, op. cit., p61-63)

With the development and generalisation of the money form, the divorce between use-value and exchange-value becomes ever wider. Those involved within the money system of commodity production and exchange become increasingly alienated from their labour. The things they produce are not useful to them, but simply for others. All needs, as mentioned earlier, become relegated to the need for money – that universal equivalent that can be exchanged for all other commodities in order to satisfy ever need imaginable.

As discussed earlier, within primitive communities, where production is a communal process, such alienation does not exist and commodity production is initially limited to those objects that are exchanged at the fringes of society with other communities. But the dynamics and laws of commodity production and exchange have a logic of their own that, once started, unravel and impose themselves throughout society. As Marx notes, “as soon as products have become commodities in the external relations of a community, they also, by reaction, become commodities in the internal life of the community.” (Marx, op.cit., p182)

In other words, as soon as the products of labour are externally traded, thus putting the relative labour times of said products in comparison to one another, the same comparison necessarily begins between the products of labour internal to a community, products which were previously not exchanged between private individuals, but instead produced as part of the common good. The laws of commodities thus begin to assert themselves within society and the separation between use-value and exchange-value is established.

“In the course of time, therefore, at least some part of the products must be produced intentionally for the purpose of exchange. From that moment the distinction between the usefulness of things for direct consumption and their usefulness in exchange becomes firmly established. Their use-value becomes distinguished from their exchange-value.” (Marx, op.cit., p182)

Marx’s analysis of the development of money, therefore, is based on an understanding of the development of the commodity, as outlined above. As commodity production and exchange becomes increasingly generalised, we see the general form of value emerge. Each individual producer wishes to exchange their particular product with the multitude of products found on the market.

As this system becomes universal, there grows a social need for a measure of value – for a universal equivalent and a unit of account that can act as a yardstick, against which the value of all other commodities can be compared. It is this universal equivalent or unit of account that forms the basis for money.

The concept of money, then, is the ultimate form of the alienation of the producer from his/her labour. No longer do we see production for direct consumption; nor are commodities produced as exchange-values for the owner, to be simply traded directly for other commodities that are use-values for the receiver. Now, instead, the producer demands money in exchange for his products – money that represents the most abstract and universal form of labour, devoid of any use-value for the owner, save that of its ability to universally represent the value of his own labour.

“Money necessarily crystallises out of the process of exchange, in which different products of labour are in fact equate with each other, and thus converted into commodities. The historical broadening and deepening of the phenomenon of exchange develops the opposition between use-value and value which is latent in the nature of the commodity. The need to give an external expression to this opposition for the purposes of commercial intercourse produces the drive towards an independent form of value, which finds neither rest nor peace until an independent form has been achieved by the differentiation of commodities into commodities and money. At the same time, then, as the transformation of the products of labour into commodities is accomplished, one particular commodity is transformed into money.”(Marx, op.cit., p181)

The enigma of profit

At a certain point, this growing alienation – tied to the separation of use-value from exchange-value – leads to a qualitative transformation. Initially, the circuit of commodity production and exchange is that of C-M-C: commodities (C) are produced, sold for money (M), and the money is then used to allow the purchase of other commodities (C).

Later on, however, this circuit turns into its opposite – that of M-C-M: we begin with money, which is used to buy commodities, in the hope of selling these on. This development of this M-C-M circuit is associated with the rise of the merchant class, as described by Engels in the earlier passage – “a class which no longer concerns itself with production, but only with the exchange of the products.”

Of course, in reality, it is not an M-C-M circuit, but an M-C-M’ circuit, where M’ represents a sum of money greater than the initial money outlay. The aim of the merchant, in other words, is simply to make money through the act of exchange. The accumulation of money becomes the sole raison d’être of the system; the fulfilment of society’s needs a mere afterthought.

At the same time, as Engels also explains, arises the usurers – the money lenders and financiers who seek to cut out the hassle of buying and selling altogether, hoping to make money from money: M-M’.

Whilst both merchants and usurers played (and continue to play) a necessary role within the market system, in that they facilitated the expansion of trade and the uninterrupted continuity of commodity circulation, these social groups were (and are) nevertheless at the same time incredibly parasitic. Ultimately, neither the merchant nor the money lender produces any new value through their own actions. Instead, their profits merely represent a transfer of wealth – a slice of the value produced elsewhere, in real production.

The enigma of profit’s origins within capitalism was a problem that had baffled and thwarted the classical economists, who maintained that profit was obtained in the process of exchange, like that of the merchant, by “buying cheap and selling dear”. But, as Marx pointed out, whilst such an act might allow one individual to swindle another, it could not explain how profit was derived for society as a whole. For in a generalised system of commodity production and exchange, we are all buyers and sellers. Even the capitalists are both sellers and buyers: of course they sell a product, but they must first buy in raw materials, invest in machinery, and pay out wages to workers. In other words, what is gained by “cheating” with one hand will simply be lost later with the other. One man’s loss is another’s gain and vice-versa.

“Suppose then that some inexplicable privilege allows the seller to sell his commodities above their value, to sell what is worth 100 for 110, therefore with a nominal price increase of 10 per cent. In this case the seller pockets a surplus-value of 10. But after he has sold he becomes a buyer. A third owner of commodities now comes to him as seller, and he too, for his part, enjoys the privilege of selling his commodities 10 per cent too dear. Our friend gained 10 as a seller only to lose it again as a buyer. In fact the net result is that all owners of commodities sell their goods to each other at 10 per cent above their value, which is exactly the same as if they sold them at their true value. A universal and nominal price increase of this kind has the same effect as if the values of commodities had been expressed for example in silver instead of in gold. The money-names or prices of the commodities would rise, but the relations between their values would remain unchanged.” (Marx, op.cit., p263)

“The value in circulation has not increased by one iota; all that has changed is its distribution between A and B. What appears on one side as a loss of value appears on the other side as surplus-value; what appears on one side as a minus appears on the other side as a plus…The capitalist class of a given country, taken as a whole, cannot defraud itself.” (Marx, op.cit., p265-266)

If not from the act of exchange and in the sphere of circulation, where then does profit come from? Our capitalist must begin with money, purchase commodities at their true cost, sell his product at a fair price, and yet end up with more money that he started with. “[O]ur friend the money owner,” therefore, “must be lucky enough to find within the sphere of circulation, on the market, a commodity whose use-value possesses the peculiar property of being a source of value, whose actual consumption is therefore itself an objectification of labour, hence a creation of value.” (Marx, op.cit., p270)

In other words, there must be a commodity that the capitalist can buy that itself is able to create value. And as Marx explains, “the possessor of money does find such a special commodity on the market: the capacity for labour, in other words labour-power.” (Ibid)

This labour-power – the “capacity for labour” – is normally expressed in terms of employment for a given period of time. For example, workers are employed on contracts that specify a number of hours per week or weeks per year that they are due to work for the capitalist. How efficiently or how hard they work in this time – that is, how much they actually produce in a given week or year – is then a question for the capitalist to optimise separately. The capitalist pays for the worker’s time; it is then up to the capitalist to utilise this time as effectively as possible in order to produce as much as possible.

The qualitative leap forward by Marx, therefore, was to see that workers themselves are not only the buyers of commodities, but are also the sellers of a very special commodity: their labour power – their ability to work. What the capitalist buys from the worker, therefore, is not his/her actual labour, i.e. the products of his/her work, but his/her ability or capacity to work.

Like all other commodities, Marx explained, “The value of labour-power is determined, as in the case of every other commodity, by the labour-time necessary for the production, and consequently also the reproduction, of this specific article…in other words, the value of labour-power is the value of the means of subsistence necessary for the maintenance of its owner.” (Marx, op.cit., p274)

In monetary terms, the price of labour-power is represented by the wages paid to the working class. This wage, therefore, must be able to cover the necessary expenditure for worker to maintain himself/herself, including food, shelter, clothing, healthcare, education. Furthermore, Marx emphasises that the value of labour-power must cover not only the expenditure of the individual worker, but also his/her family, and indeed the continued existence of the working class a whole.

The social wage necessary, therefore, is not simply that required for the bare minimal subsistence of the working class, but is that of a given social and historical situation, varying from country-to-country and from epoch-to-epoch. The working class, through a history of class struggle, has raised the expectation of what an average wage – and thus an average standard of living – should be. The value of labour-power, therefore, is ultimately determined by a class struggle between the working class and the capitalist class; a struggle for higher wages on the side of the workers, and greater profits on the side of the capitalists.

The key to the capitalists’ profits lies in the ability of the workers to create more value in the course of the day than they are paid back in the form of wages. For example, whilst the working day may be eight hours, it might take only half the day – four hours – for workers to produce commodities with a value equivalent to their wages. In other words, the remaining four hours of the workers’ labour, from the perspective of the capitalists – are effectively “free”, and the products created in this period constitute surplus value.

The source of the capitalists’ profits then, lies not in exchange or circulation, but in production. Profits are obtained from this surplus value – the unpaid labour of the working class. The remaining surplus value, meanwhile, is divided up – in the form of rent and interest – between the various parasites that thrive off of the wealth created in real production: the landlords, usurers, and financiers.

It is the pursuit of profit, in turn, that acts as the motor force within capitalist society, with the competition to sell cheaper, capture markets, and increase profits driving investment into new technologies, in order to increase productivity. With the crash of 2008 and the years of crisis and worldwide economic stagnation that have followed, however, it is clear that this engine has stalled.

The growth of finance

It has become popular to blame the crisis on such parasitic layers of spivs and speculators, given the role that the bloated financial sector played in the events leading up to the 2008 collapse of the banking system that marked the onset of the Great Recession. But whilst it is true that finance and banking have ballooned out of all proportion, dominating the world economy today, the reality is that usurers and money lenders have existed throughout capitalism’s history – indeed, going back further, as Engels notes in relation to ancient Greece, for as long as money itself.

The most basic elements of banking – a system of accounts and loans – were even present thousands of years ago, within the ancient Mesopotamian societies described earlier. In these early urban economies, and in other later societies such as that of ancient Egypt, not only were individual goods kept and recorded at central storehouses for safe-keeping, but people could borrow from these same storehouses in order to fulfil immediate needs.

“The lending system of ancient Babylon was evidently quite sophisticated,” Niall Ferguson, the bourgeois historian, writes in his book The Ascent of Money. “Debts were transferable…Clay receipts or drafts were issues to those who deposited grain or other commodities at royal palaces or temples. Borrowers were expected to pay interest…at rates that were often as high as 20 per cent.” (Niall Ferguson, The Ascent of Money: a Financial History of the World, Penguin Books, 2009 paperback edition, p31)

Later on in Ptolemaic Egypt and Hellenistic Greece emerged the innovation of credit transfers, allowing cash transactions to be replaced in part with a system of credit receipts and payments. For example, on the Greek island of Delos, individual clients could “transfer money” simply by sending instructions to the bank to make payments to another person’s account. Delos’ banking methods, in turn, became the model for the Romans. Meanwhile, with the development of international trade and commerce, and the Romans’ preference for coinage, banking expanded to involve the exchange of minted coins of different origin.

With the collapse of the Roman Empire came the collapse of international trade and the banking system also. As Felix Martin comments, “the social and political stability required to underpin professional finance had, it seems, disintegrated.” (Martin, op. cit., p83) Markets shrank, the subsistence economy grew, and the money system regressed back both in terms of its size and complexity, primarily consisting of a multitude of coinages catering to local fiefdoms and kingdoms.

Feudal lords and kings, meanwhile, would frequently use their privileged monopoly position as minters to manipulate the money supply and enrich themselves. The sovereign, in effect, could tax the holders of money by debasing the currency, changing the nominal value of the coins in circulation and pocketing the difference – a process known as seigniorage.

This continual process of debasement, over time, served to reinforce the symbolic nature of coins and their primary role as a representation of value, paving the way for paper money (which was originally invented in 8th century China) and even the electronic money we use today – mere digital information on a screen. Money, in effect, becomes a mere token – a symbol of value, as Marx notes:

“The fact that the circulation of money itself splits the nominal content of coins away from their real content, dividing their metallic existence from their functional existence, this fact implies the latent possibility of replacing metallic money with tokens made of some other material…

“Relatively valueless objects, therefore, such as paper notes, can serve as coins in place of gold. This purely symbolic character of the currency is still somewhat disguised in the case of metal tokens. In paper money it stands out plainly. But we can see: everything depends on the first step.” (Marx, op. cit., p223-224)

At the same time, this seigniorage was sowing the seeds for a monetary rebellion. Those in possession of money were finding themselves consistently robbed by the state; an alternative had to be found.

The shift in power came with the restoration of banking to its former glories. As international trade expanded once again, a new mercantile class emerged, centred on the medieval Italian city-states. A division of labour occurred within commerce, and international merchant houses grew who were concerned less with the transfer of the actual commodities (which was left to lesser mortals), and more with the transfer of wealth and property rights.

Rather than dealing with the myriad of currencies that could be found across the continent, the great European merchant houses in time came to circumvent the sovereign altogether, playing the role of bankers. Local tradesmen would deal with the merchant houses, who in turn would deal with one another to settle accounts, thus creating an international system of IOUs (such as cheques and bills of exchange) and payments.

As the wealth of the rising merchant class grew, so did their power and influence. The state became increasingly reliant on this nascent bourgeoisie as a source of funds for their expenditure – in particular, to wage wars. The major shift in class relations can be seen in the way in which such public funds were obtained, as Ferguson notes in relation to the city-state of medieval Florence: “Instead of paying a property tax, wealthier citizens were effectively obliged to lend money to their own city government. In return for these forced loans, they received interest.” (Ferguson, op. cit. p72) The merchant bankers had become the state’s creditors. The era of public debts had begun.

In principle, the idea of state debt makes little sense. The same result – i.e. the government raising money for state expenditure – could just as well be achieved through taxing the rich, rather than borrowing from them. Of course, from the perspective of the wealthy, lending the government money (in the form of credit) rather than giving it over (in the form of taxes) is far more preferable: the rich get to keep their money, and at the same time earn a tidy sum on the side from interest.

The concept of a sovereign debt was not new to the capitalist epoch. Monarchs had frequently borrowed from the rich and wealthy; the problem previously, however, was that such royalty would often default on their loans. Tired of losing their money, the rising bourgeois class in England pushed through with the establishment of a national bank – the Bank of England – in 1694, which would guarantee the repayment of government debts and give the financial lenders monopoly privileges over the money supply – that is, over the issuing of new banknotes.

“To be granted the privilege of note issue by the crown,” Felix Martin writes, “which would anoint the liabilities of a private bank with the authority of the sovereign – this, they realised, was the Philosopher’s Stone of money. It was the endorsement that could liberate private bank money from its parochial bounds. They would lend their credit to the sovereign – he would lend his authority to their bank. What they would sow by agreeing to lend, they would reap a hundredfold in being allowed to create private money with the sovereign’s endorsement. Henceforth, the seigniorage would be shared.” (Martin, op. cit., p118)

Alongside the national debt developed the fiscal (taxation) system. With debts to repay, the state was required to establish a means through which to raise the taxes needed to fund these debts and interest payments. The result, however, as seen now in debt-laden countries across the world, is that the tail ends up wagging the dog. Government policy begins to revolve entirely around paying back the debts to its financial creditors, and – as is aptly demonstrated in modern day Greece – new loans are required just to pay off the old ones.

So it comes about that the bourgeoisie takes complete control over the running of the country – not through the electoral apparatus of a country, but by dictating policy to governments using strikes of investment and the threat of national insolvency. This is what we see today, where governments of every colour are carrying out the same policies of austerity under the aegis of international finance capital – and this is what is meant by the dictatorship of capital, which rides roughshod over democracy in this time of crisis.

“The national debt, i.e. the alienation of the state – whether that state is despotic, constitutional, or republican – marked the capitalist era with its stamp. The only part of the so-called national wealth that actually enters into the collective possession of a modern nation is – the national debt.” (Marx, op. cit. p919)

Credit and crisis

Banking and finance are fundamentally based upon money’s role as a means of payment – a promise by the buyer to pay in the future. This “function of money as a means of payment,” Marx notes, however, is not unique to the capitalist epoch, but “develops out of simple commodity circulation, so that a relationship of creditor and debtor is formed.”

“With the development of trade and the capitalist mode of production,” Marx continues, “this spontaneous basis for the credit system is expanded, generalised and elaborated.” Whereas coinage – that is, money as a means of purchase – once dominated, “money now functions only as means of payment, i.e. commodities are not sold for money, but for a written promise to pay at a certain date.” (Karl Marx, Capital, Volume Three, Penguin Classics edition, p525)

In other words, with money as a means of payment, it is possible to buy without having first sold; to own without actually paying anything in return. A disconnect develops between the commodities exchanging hands and the actual ability to pay for these commodities. Fragility, uncertainty and risk are introduced into the system, which only increases as “the credit system is expanded, generalised and elaborated”.

The complexity – and with it, the fragility – of the credit system took a qualitative leap forward with invention of fractional reserve banking in the 17th century. Whereas the banking system up until then had been primarily concerned with exchanges between accounts, or the provision of loans fully backed up by reserves, now banks began “lending amounts in excess of its metallic reserve…exploiting the fact that money left on deposit could profitably be lent out to borrowers.” (Ferguson, op. cit., p50)

In their role as lenders of credit, the banks play a dual role for the capitalists. On the one hand, relatively short-term credit is required to overcome bottlenecks in production and maintain the flow and circulation of commodities. For example, producers need to borrow money to pay for wages and raw materials whilst they wait for previous produced goods to reach the market and be sold.

On the other hand, credit may be used to allow producers to expand production when they don’t have the upfront capital to pay for it. In this respect, the banking and finance system serves to pool together and accumulate all the small savings and idle money within the economy – primarily those of individuals and households – in order to put them to use productively as investment in new means of production.

With the invention of fractional reserve banking, however, banks were no longer mere lenders of credit – they became the creators of credit, and thus the creators of money also. Only a fraction of deposits are backed up by liquid assets, the rest are simply loans created by the bank (at interest) in order to provide greater profits for the bank, thus increasing the money supply in the process. The credit lent appears in the form of a deposit in the bank account of the borrower, who can then spend this just as he/she would spend any other money.

Today, according to the UK-based campaigning group Positive Money, whose aim is to “democratise money and banking”, upto 97% of the money supply in the British economy is the creation of banks, with only 3% existing in the form of cash.

In this respect, credit plays another key role within capitalism: artificially expanding the market – that is, the purchasing power within the economy. At root, capitalism is a system of production for profit. If the capitalists cannot make a profit, then they will not produce; workers are made unemployed, investment dries up, circulation stops. The economy grinds to a halt and the credit system breaks down – that is to say: capitalism enters into crisis.

“As long as the reproduction process is fluid, so that returns remain assured, this credit persists and extends, and its extension is based on the extension of the reproduction process itself. As soon as any stagnation occurs, as a result of delayed returns, overstocked markets, or fallen prices, there is a surplus of industrial capital, but in a form in which it cannot accomplish its function. A great deal of commodity capital; but unsaleable. A great deal of fixed capital; but in large measure unemployed as a result of stagnation in reproduction. Credit contracts, 1) because this capital is unoccupied, i.e. congealed in one of its phases of reproduction, because it cannot complete its metamorphosis; 2) because confidence in the fluidity of the reproduction process is broken; 3) because the demand for this commercial credit declines…

“So if there is a disturbance in this expansion, or even in the normal exertion of the reproduction process, there is also a lack of credit; it is more difficult to obtain goods on credit. The demand for cash payment and distrust of credit selling is especially characteristic of the phase in the industrial cycle that follows the crash…Factories stand idle, raw materials pile up, finished products flood the market as commodities.” (Marx, Capital, Volume Three, p614)

With a default on any debts, the anarchy and chaos within the balance of payments becomes apparent. Creditors demand their repayments and refuse to lend any further. Promises to pay lose any meaning; only hard cash will suffice. Credit is reined in, bringing the motion of circulation – and thus production also – to a halt. In short, the lack of credit does not cause a crisis; the crisis causes a lack of credit.

“This contradiction bursts forth in that aspect of an industrial and commercial crisis which is known as a monetary crisis. Such a crisis occurs only where the ongoing chain of payments has been fully developed, along with an artificial system for settling them. Whenever there is a general disturbance of the mechanism, no matter what is cause, money suddenly and immediately changes over from its merely nominal shape, money of account, into hard cash. Profane commodities can no longer replace it. The use-value of commodities becomes valueless, and their value vanishes in the face of their own form of value.” (Marx, Capital, Volume One, p236)

“In a system of production where the entire interconnection of the reproduction process rests on credit, a crisis must evidently break out if credit is suddenly withdrawn and only cash payment is accepted, in the form of a violent scramble for means of payment. At first glance, therefore, the entire crisis presents itself as simply a credit and monetary crisis. And in fact all it does involve is simply the convertibility of bills of exchange into money. The majority of these bills represent actual purchases and sales, the ultimate basis of the entire crisis being the expansion of these far beyond the social need. On top of this, however, a tremendous number of these bills represent purely fraudulent deals, which now come to light and explode; as well as unsuccessful speculations conducted with borrowed capital, and finally commodity capitals that are either devalued or unsaleable, or returns that are never going to come in.” (Marx, Capital, Volume Three, p621)

At the heart of these crises is a fundamental contradiction within capitalism: that of overproduction. This arises from the nature of capitalism as a system of profit, and from the origins of profit itself – as explained earlier – as the unpaid labour of the working class. Since workers produce more value than they are paid back in the form of wages, the working class as a whole can never buy back the full value of the commodities it creates.

Capitalism traditionally overcomes this contradiction of overproduction by reinvesting the surplus value created into new means of production in the search for greater profits. This, however, only serves to create even greater productive forces, and thus an even greater mass of commodities that must find a market, and thus – rather than resolving the contradiction – only further exacerbates overproduction.

Credit, then, is used to artificially increase the consumptive capacity of the masses, and thus to temporarily overcome overproduction, allowing the productive forces to continue growing and the market to expand beyond its limits – but only by sowing the seeds for an even bigger crisis in the future.

Today, the capitalist system has extended far beyond its limits. The expansion of credit over the past thirty years – and particularly since the turn of the century – created the largest credit bubble in history. On the one hand, as a result of globalisation, automation, and a full-frontal assault against the working class, wages were driven down, and an ever-increasing proportion of wealth began to go to capital rather than labour. On the other hand, credit was massively expanded through the use of mortgages, credit cards, student loans, etc., in order to artificially maintain demand. Whilst this had the effect of delaying the onset of crisis, it at the same time paved the way for the almighty collapse of 2008 and the continued chaos that we see today, as all the contradictions that have piled up for decades now come to the fore.

At root, it is the restricted consumption of the masses that prepares the way for crises under capitalism. The market is not only restricted by the amount of money that people have in their pockets to spend on goods and services (and the huge debts that hang around their necks), but also by the enormous level of excess capacity that has built up throughout the economy, creating a gigantic barrier to further investment. Today, the world is awash with such excess capacity; the market is saturated and the capitalists have had to cut back on production. Their attempt to overcome the crisis by credit has reached its limits. The productive forces have far outgrown the limits of the capitalist system.

Money and Capital

“After the advent of banking and the birth of the bond market,” Niall Ferguson comments in his Financial History of the World, “the next step in the story of the ascent of money was…the rise of the joint-stock, limited-liability corporation.” “It is the company,” Ferguson notes, “that enables thousands of individuals to pool their resources for risky, long-term projects that require the investment of vast sums of capital before profits can be realised.” (Ferguson, op. cit., p121)

With the advent of the joint-stock company, business owners were no longer purely reliant on the banks in order to obtain credit for making large-scale investments. Instead, such money could be raised from the accumulation of many small (or large) sums, by selling to shares in the company to anyone who was willing to risk their savings in return for a portion of future profits.

As Marx emphases in Capital, however, such shares are not a share in the actual company itself, but rather are “an ownership title, pro rata, to the surplus-value which this capital is to realise”; “nothing but accumulated claims, legal titles, to future production”; “a legal claim to a share of the surplus-value that this capital is to produce”. (Marx, Capital, Volume Three, p597; p599 ; p608)

Today, giant financial firms, through the stock market, control the process of buying, selling, and trading shares as part of the wider credit system. Anyone with any savings or private pension is tied into this system, with investment banks and pension fund managers amalgamating the population’s nest eggs into larger amounts that can be invested to make a profit.

It is clear, however, that there is a qualitative difference between money and capital. Whilst millions of people may have money invested in shares through their savings or pension, this does not make every thrifty saver or pension holder a capitalist. Only a tiny minority have enough money that they can live purely off the returns from stocks and shares.

Despite the propaganda of the bourgeoisie and their mouthpieces (for example, the rhetoric of Margaret Thatcher, who sought to create a middle-class “property-owning democracy” by selling off council housing and privatising nationalised industries), the stock market does not serve to diversify society’s wealth and convert laymen into capitalists. Rather, the main function of the highly developed credit system that we see under capitalism is to do the opposite: to concentrate and “capitalise” all the small, scattered sums of money in the hands of a rich and powerful elite of bankers and financiers; to convert all money into capital – that is, into value that is capable of creating more value.

“Small sums which are incapable of functioning as money capital by themselves are combined into great masses and thus form a monetary power.” (Ibid, p529) “In so doing,” Lenin remarks in his Marxist masterpieceImperialism, the Highest Stage of Capitalism, “they [the banks and financial firms] transform inactive money capital into active, that is, into capital yielding a profit; they collect all kinds of money revenues and place them at the disposal of the capitalist class.” (Lenin, Imperialism, the Highest Stage of Capitalism, Chapter II)

At the same time, the credit system serves to divorce the capitalists ever more from the process of real production. With the advent of joint-stock companies, the capitalist ceases to be the business owner or manager, and capital itself become less and less about owning actual tangible assets. Instead, the capitalist becomes simply “capital personified”, and capital ownership – in the form of stock and shares – is transformed simply into a claim to a share of the total surplus value produced in society; an asset that entitles the owner to a constant revenue stream, with a return equal to the average rate of profit. It is, in the words of Marx, the “transformation of the actual functioning capitalist into a mere manager, in charge of other people’s capital, and of the capital owner into a mere owner, a mere money capitalist.” (Marx, op. cit., p567)

It is the dominance of the banks, stock market, cartels, and monopolies, meanwhile, with the transformation of capital into primarily finance capital, that Lenin noted as being a defining characteristic of imperialism – the “highest stage of capitalism”:

“It is characteristic of capitalism in general that the ownership of capital is separated from the application of capital to production, that money capital is separated from industrial or productive capital, and that the rentier who lives entirely on income obtained from money capital, is separated from the entrepreneur and from all who are directly concerned in the management of capital. Imperialism, or the domination of finance capital, is that highest stage of capitalism in which this separation reaches vast proportions. The supremacy of finance capital over all other forms of capital means the predominance of the rentier and of the financial oligarchy.” (Lenin, op. cit., Chapter III)

The rise of the stock market and the credit system, then, acts to accelerate the socialisation of production, with businesses appearing “as social enterprises as opposed to private ones”. “This is the abolition of capital as private property within the confines of the capitalist mode of production itself.” (Marx, op. cit., p567).

On the one hand, this gives as an enormous boost to the development of the productive forces, enabling investment in new means of production on a scale that could never be achieved on the basis of individual private ownership. This provides a glimpse of what could be possible under a socialist plan of production, where the productive forces and resources in the economy were utilised according to a rational and democratic plan, on the basis of society’s needs, rather than for the profits of the bankers and bosses.

On the other hand, this same credit system gives rise to an orgy of speculation and “reproduces a new financial aristocracy, a new kind of parasite in the guise of company promoters, speculators and merely nominal directors; an entire system of swindling and cheating with respect to the promotion of companies, issue of shares and share dealings. It is private production unchecked by private ownership.” (Ibid, p569)

Trading and exchange of financial commodities become merely a means of attempting to make money out of money. Financial assets increasingly become mere fictitious capital. Activity on the stock market becomes ever more separated from the state of the real economy below, with prices of such stocks and shares ceasing to reflect the actual health of the companies whose value they are supposed to represent, giving rise to an endless froth of bubbles being vastly inflated only to later burst up against the pinpricks of reality. As Niall Ferguson remarks:

“In the four hundred years since shares were first bought and sold, there has been a succession of financial bubbles. Time and again, share prices have soared to unsustainable heights only to crash downwards again. Time and again, this process has been accompanied by skulduggery, as unscrupulous insiders have sought to profit at the expense of naive neophytes.” (Ferguson, op. cit., p122)

And, of course, as we see from the financial crash of 2007-08, it is always the working class who are left to foot the bill for such recklessness, whilst the rich and wealthy continue to laugh all the way to the bank.

Far from being a malevolent tumour on the side of an otherwise benevolent system, however, we can see that such financial alchemy and “skulduggery” of “swindling and cheating” are an intrinsic part of the capitalist system that cannot be removed. The development of capitalism, from its mercantile beginnings in southern Italy to the Industrial Revolution in England, was only possible due to the development of finance capital and the role it played in concentrating capital, expanding the productive forces, and creating the world market. Any separation between the “good” capitalism of industry and manufacturing, on the one side, and the “bad” capitalism of the “parasitic” and “irresponsible” finance sector, on the other, is purely artificial and completely idealistic.

Instead of attempting to regulate the unruly beast of finance and banking in order to create the utopia of a “responsible capitalism”, the leaders of the labour movement should instead put forward the demand for the nationalisation of the banks under the control of the organised working class. Only in this way can the wealth in society be pooled and planned in the interest of the many.

“The credit system hence accelerates the material development of the productive forces and the creation of the world market, which it is the historical task of the capitalist mode of production to bring to a certain level of development, as material foundations for the new form of production. At the same time, credit accelerates the violent outbreaks of this contradiction, crises, and with these the elements of dissolution of the old mode of production.

“The credit system has a dual character immanent in it: on the one hand it develops the motive of capitalist production, enrichment by the exploitation of others’ labour, into the purest and most colossal system of gambling and swindling, and restricts ever more the already small number of the exploiters of social wealth; on the other hand however it constitutes the form of transition towards a new mode of production.” (Marx, op. cit., p572)

The scourge of inflation

Whilst minted coins may bear the faces of the heads of state with whose authority they have been issued, it is important to stress that this does not mean that money was ever “invented” or imposed from above. Rather, it is an emergent social device within a society where a market economy has developed, as Graeber emphasises:

“The reasons why anthropologists haven’t been able to come up with a simple, compelling story for the origins of money is because there’s no reason to believe there could be one. Money was no more ever ‘invented’ than music or mathematics or jewellery. What we call ‘money’ isn’t a ‘thing’ at all; it’s a way of comparing things mathematically…” (Graeber, op. cit. p52)

Although it is emergent, and not imposed or invented, the relations represented by money are nevertheless based on something that is objective and real – that is, the socially necessary labour time embodied within society’s total wealth of commodities in circulation.

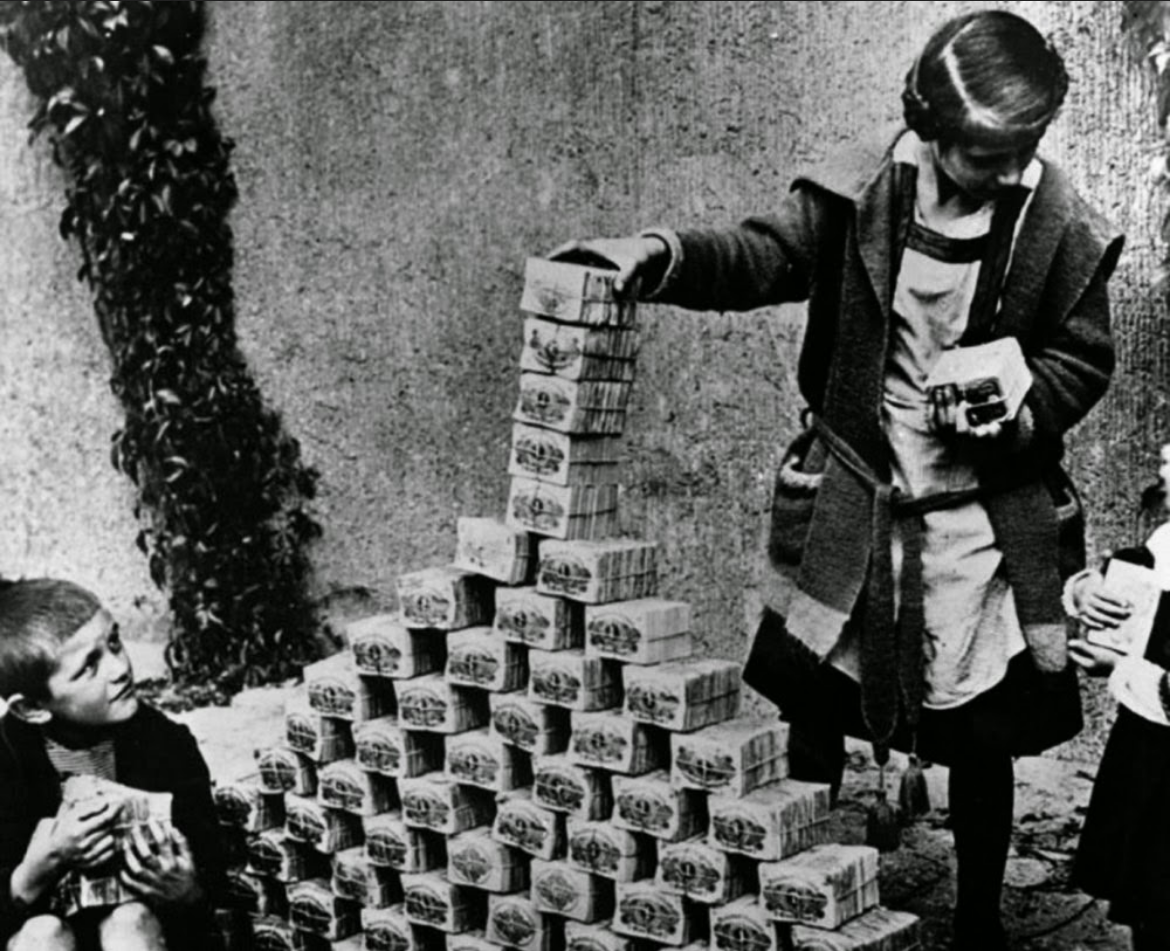

The real wealth of a society, in other words, consists not in its accumulation of coins and cash, nor in bubbles of credit and debt, but in the level of the productive forces – and resultant use-values – at its disposal. Indeed, as discussed earlier, many a regime or ruler in history has been reminded of this fact when attempting to increase their wealth simply through debasement of the currency or printing money – a technique that universally leads to creating greater economic instability and ultimately, ironically, to the impoverishment of the society in question.

Whilst there is no apparent limit to the amount of money that can be put into circulation, then, it is nevertheless clear that this amount is not arbitrary. As explained earlier, money is above all a measure of value – the universal measure of value. The amount of money in circulation, therefore, must ultimately be linked to the total value of commodities in circulation – equivalent in money terms to the total of the prices – and to the speed (the velocity or turnover) with which this money exchanges hands. For example, all things being equal, if the quantity of commodities remains constant but the amount of notes in circulation doubles, then the price of each commodity will double also.

Inflation is a reflection of market forces: if the money supply increases, there will be a general increase in the demand for commodities, and thus a general rise in prices. Inflation of specific commodities can still occur in the absence of an increasing money supply, however; for example, as a result of a scarcity or restriction in the supply of certain goods, which pushes their price above their value. Similarly, if the costs of production for a particular commodity increase, i.e. there is an increase in its socially necessary labour time, these will be reflected in a relatively higher value and thus a newly inflated price for this commodity in relation to others.

A generalised inflation – that is, a general inflation in the price of all commodities – in society, then, can only take place as a result of an expansion of the money supply and a debasement (devaluation) of the currency; or as a product of a rise in the price of a commodity such as oil, which acts as an important factor in the cost of production for all other commodities.

As discussed earlier, money – both in terms of commodity money and credit money – is ultimately a set of social relations; an expression of the distribution of wealth within society. The role of such a generalised inflation, therefore, is to change the balance of these social relations and redistribute this wealth from one group to another: primarily in terms of a transfer of wealth from creditors to debtors, whose debts in real terms are diminished by inflation.